Closing Revenue Accounts Journal Entry

Prepare the entry to close the revenue account s. Here are the steps to creating closing entries.

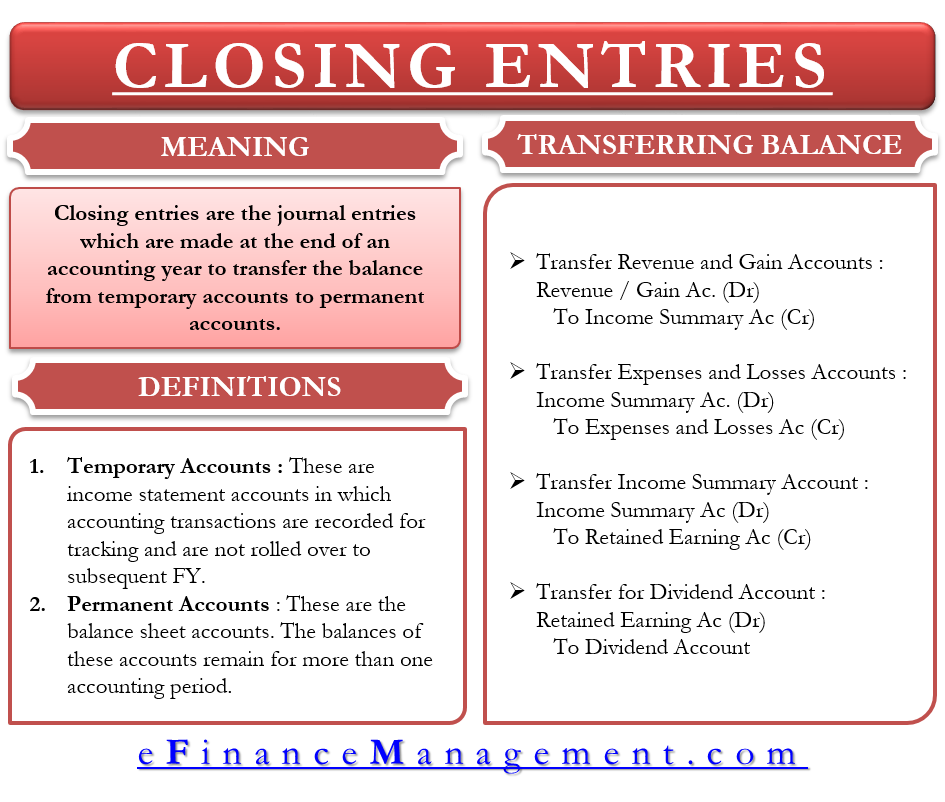

Closing Entries Concept Types Examples Efinancemanagement

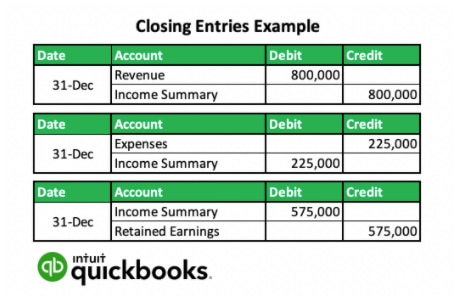

After transferring the balance from all revenue and expenses to the income summary account the company can make the journal entry to.

. When entering an intercompany transaction on a journal entry there is a drop-down box at the top for Intercompany DTDF SourceThis determines which Due ToFrom accounts are used. Closing entries are journal entries used to empty temporary accounts at the end of a reporting period and transfer their balances into. Select the Income Summary account and debitcredit it by the Net Income amount noted from the Profit and Loss.

Ad Excel close management checklist by accountants for accountants. We must complete the closing entries in order to ensure that they are consistent and that the temporary accounts are zeroed out. The Accounting Cycle And Closing Process.

Create a temporary account called Income Summary Zero out the temporary revenue accounts to. Closing Income Summary. Just like revenue expense account is also closed at the end of an accounting period so that it can once again begin with nil balance.

How to optimize your close process structure your checklist keep working in Excel. How to optimize your close process structure your checklist keep working in Excel. An end journal entry is an accounting entry made at the end of an accounting period.

A closing entry is a journal entry made at the end of accounting periodsthat involves shifting data from temporary accounts on the income statement to permanent. Step one is to cancel all revenue accounts. Close means to make the balance zero.

Closing the revenue account. Create a new journal entry. Close your books faster.

Transfer the total balance of all revenue accounts to Income Summary. Your closing journal entries serve as a way to zero out temporary accounts such as revenue and expenses. When accountants shift credit balances from revenue accounts over to the income summary this is the process of closing revenue accounts.

Closing income summary to retained earnings. Another name used to describe these entries is closing journal entry. Ad Excel close management checklist by accountants for accountants.

Closing Revenue Expense and Dividend Accounts general journal entries. What are Closing Entries. We need to do the closing entries to make them match and zero out the temporary accounts.

This problem has been solved. A closing entry is a journal entry made at the end of the accounting period in which data is moved into the permanent accounts on the balance sheet. Usually end journal entries.

About the Author. We see from the. Prepare the entry to close the expense account s.

Closing Entry for Expense Account. Close revenue accounts by transferring funds to income summary account. Close your books faster.

How To Create Opening And Closing Entries In Accounting Quickbooks Canada

Closing Entries Using Income Summary Accounting In Focus

Instantcert Credit Financial Accounting Lesson 26

Closing Entries Using Income Summary Accounting In Focus

0 Response to "Closing Revenue Accounts Journal Entry"

Post a Comment